The 2019 Calculator Help You Complete Your 2019 IRS Paper Tax Forms. Individual Shutdown began on Saturday November 20 2021 at 1159.

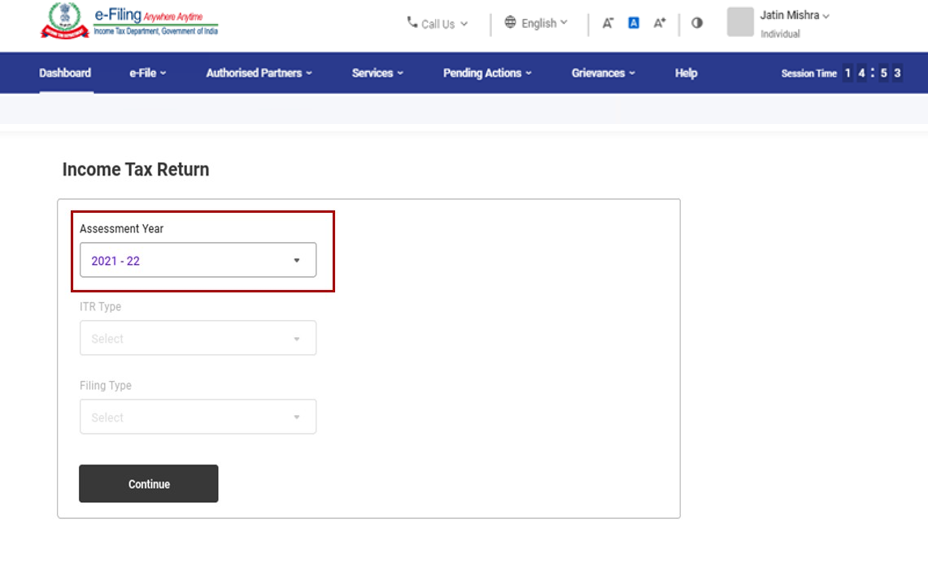

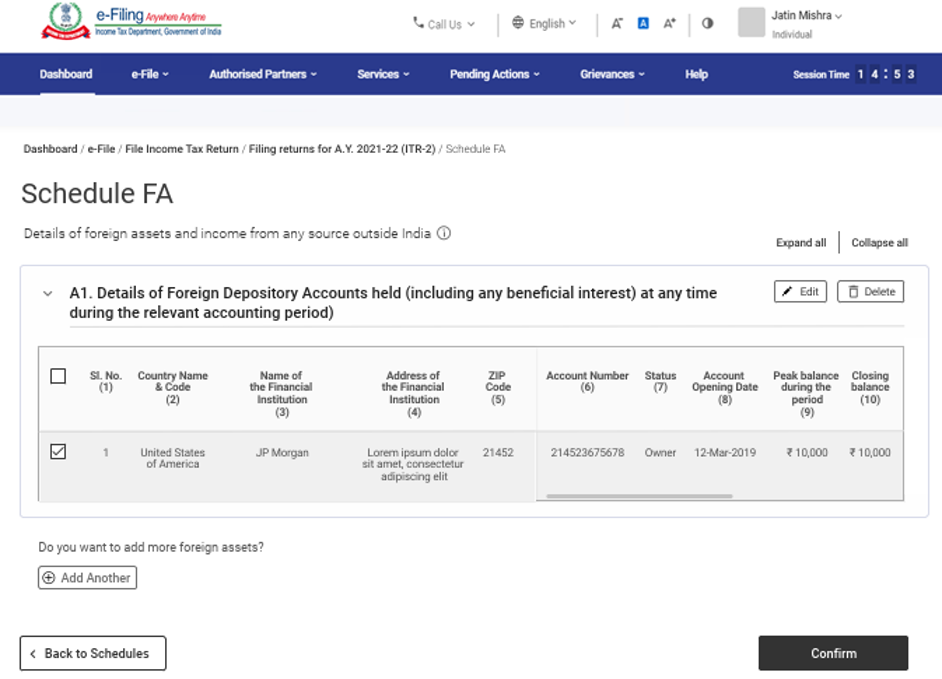

File Itr 2 Online User Manual Income Tax Department

Even when you e-file your 2019 tax return be aware that.

. The IRS MeF is used to process e-files for all major entities as well as most states. Trying to submit my personal tax returns for Federal and State GA I am getting this message. 2019 E-rate Filing Window Now Open.

We accept and process e-file returns year round. E-filing is supposed to open sometime today on January 3. It shuts down once a year for maintenance.

If October 15 falls on a weekend or legal holiday you have until midnight the next business day. 2019 IRS Federal Income Tax Return Forms and. Tax year 2019 and 2020 returns can still be e-filed when the IRS re-opens for the tax year 2021 filing season.

When can I file for 2019. The last possible date to post a Form 470 and still have a 28-day bid process will be February 27 2019. 2019 E-rate Filing Window Now Open.

What is your hurry though. Modernized e-File MeF System Resiliency. 31 2020 only use the 2020 W-4 Form.

Use web pay for businesses to make your payment. The 2019 W-4 is no longer relevant Submit the 2020 Form to your employer only not the IRS. Starting with Release 105 start date 10122021 for ATS and January 2022 for Production MeF has implemented a new feature.

The shutdown dates are. 2019 IRS Tax Forms Schedules. It shuts down once a year for maintenance.

File and pay on time April 15th to avoid penalties and fees. The IRS has announced that electronic filing of Affordable Care Act ACA information returns Forms 10941095 for the 2018 tax year will become available on January. Load and Complete the Forms Before You Mail Them to the IRS.

November 16 2019 - January. If you timely file Form 4868 you have until October 15 to timely file your return.

Section 139 5 Of Income Tax Act How To File Revised Income Tax Return Tax2win

Section 139 5 Of Income Tax Act How To File Revised Income Tax Return Tax2win

E Nivaran Complaint Registration Indiafilings

Section 139 5 Of Income Tax Act How To File Revised Income Tax Return Tax2win

Section 139 5 Of Income Tax Act How To File Revised Income Tax Return Tax2win

Faq Can I See My Refund Amount And Payment Date Or The Payment Due Date Of The Amount Owed By Me To Sars On Efiling South African Revenue Service

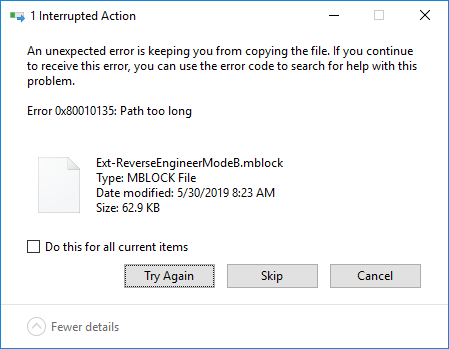

I Get A Path Too Long Error When Trying To Open An Electronic Copy Of A Book On Windows Technical Information Library

File Itr 2 Online User Manual Income Tax Department

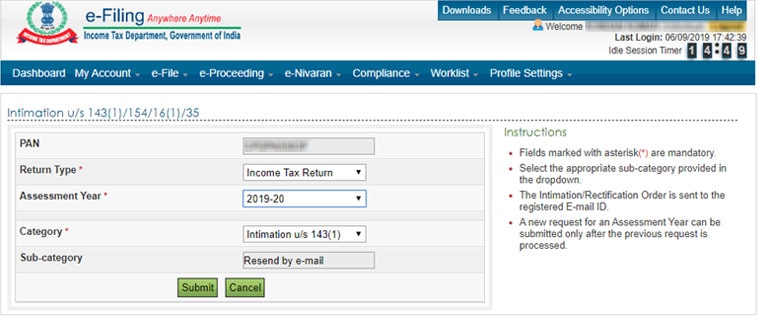

Notice U S 143 1 Income Tax Intimation U S 143 1 Tax2win

Section 139 5 Of Income Tax Act How To File Revised Income Tax Return Tax2win

Section 139 5 Of Income Tax Act How To File Revised Income Tax Return Tax2win

How To E Verifying And E Filing Income Tax Through Icici Netbanking Tax2win

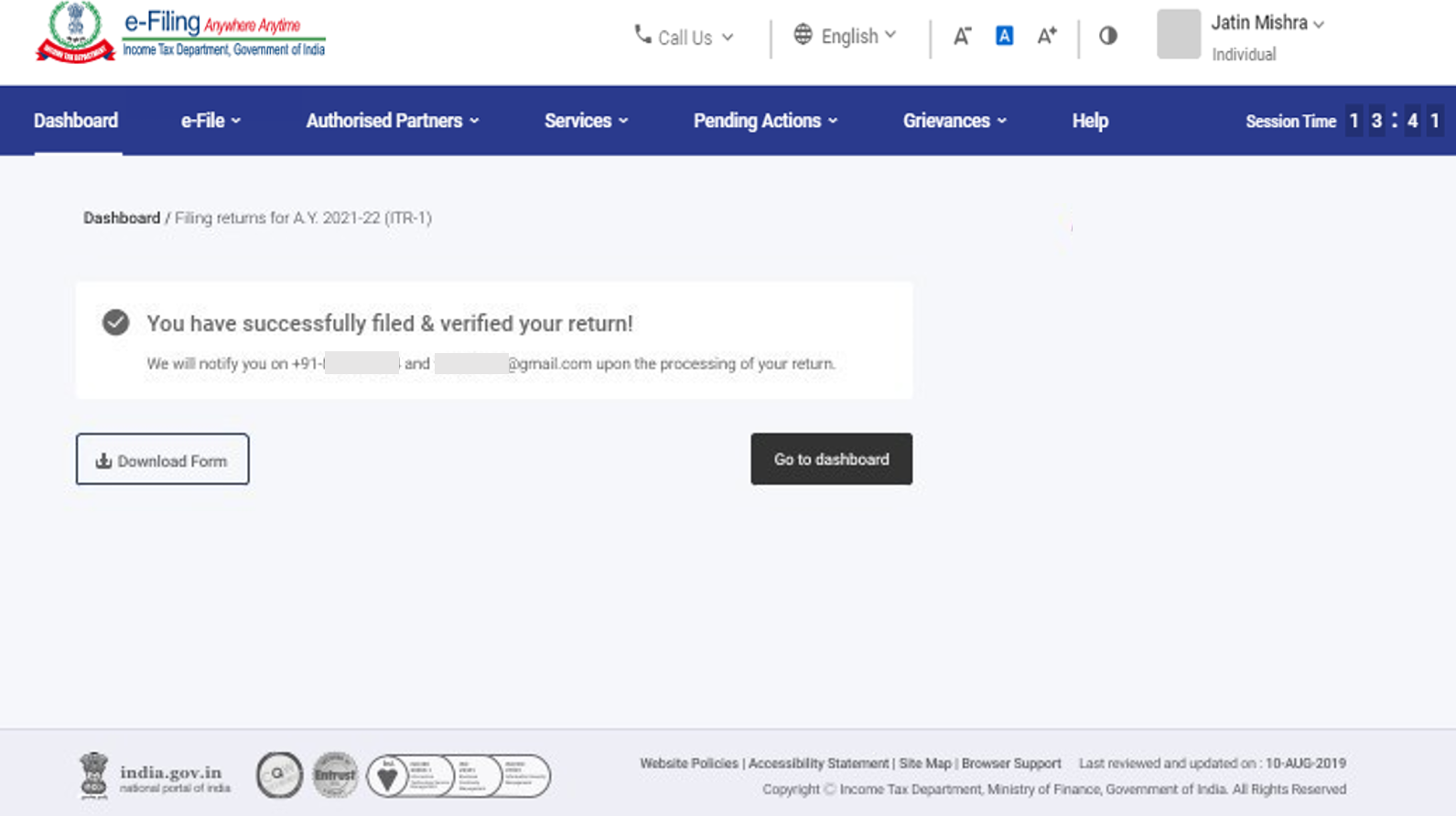

File Itr 1 Sahaj Online User Manual Income Tax Department

Faq Can I See My Refund Amount And Payment Date Or The Payment Due Date Of The Amount Owed By Me To Sars On Efiling South African Revenue Service

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

Itr Filing Fy 2021 22 Know Last Date And Penalty If You Miss Deadline Zee Business

Notice U S 143 1 Income Tax Intimation U S 143 1 Tax2win

As Per The Changed Rules Notified Under Section 234f Of The Income Tax Act Which Came Into Effect From April 1 2017 Income Tax Filing Taxes Income Tax Return